Tax and Finance

China recently lowered its value-added tax (VAT) rates, as part of an RMB 400 billion (US$64 billion) tax cut package.

China's Ministry of Finance (MOF) and the State Administration of Taxation (SAT) recently released the Circular about Adjusting the Rates on Value-added Tax, which explain the details of the new VAT rates.

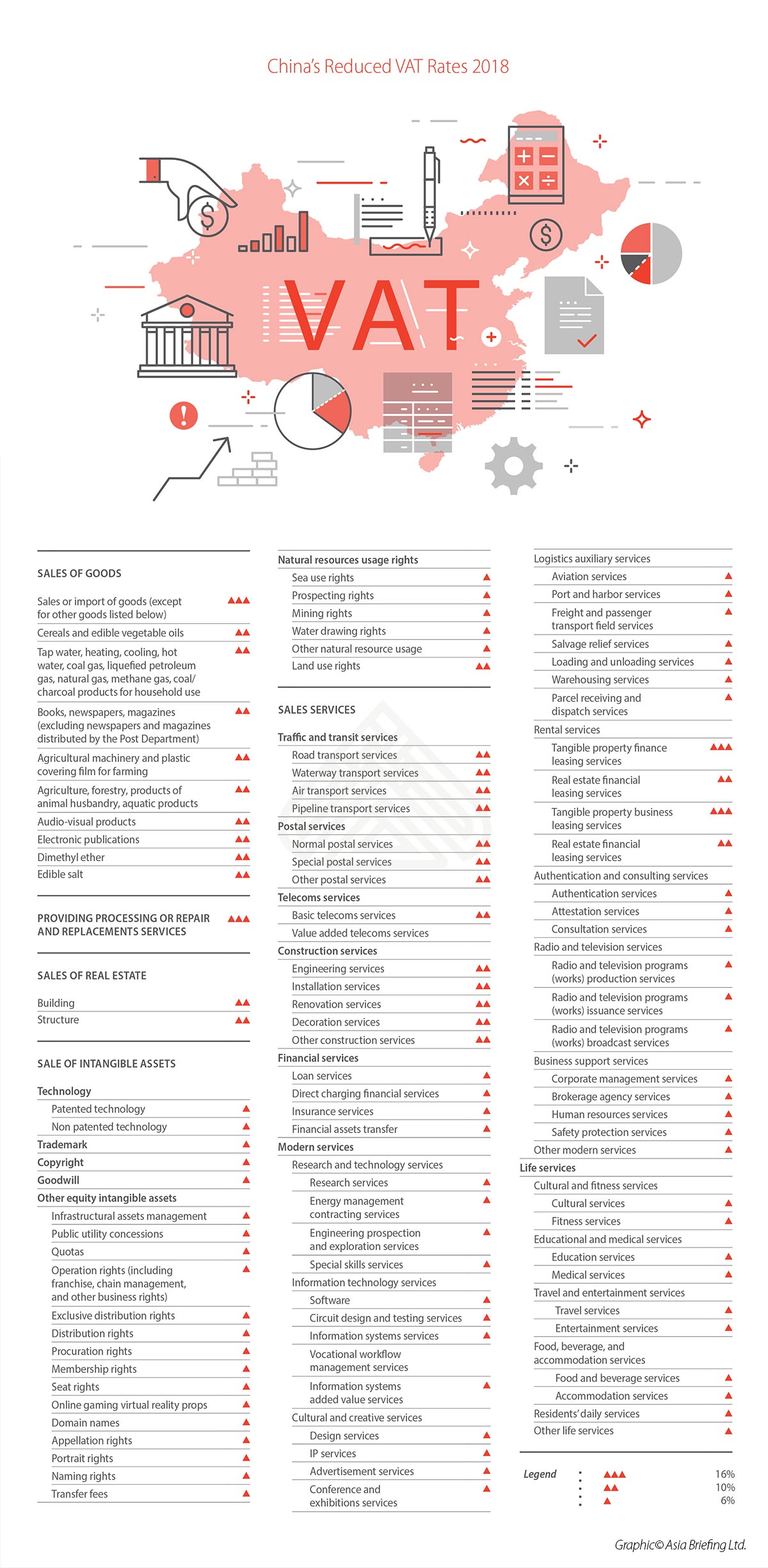

According to the circular, the tax cuts reduce the 17 percent VAT bracket to 16 percent, and the 11 percent VAT bracket to 10 percent. The six percent VAT bracket remains unchanged. The new VAT rates will go into effect on May 1, 2018.

Tax Compliance Services from Dezan Shira & Associates

The MOF and SAT also recently released a Circular about Unifying the Standards of Small VAT Taxpayers, which expands the criteria for firms to qualify as a small-scale VAT taxpayer. Small-scale VAT taxpayers are now defined as those whose annual sales are less than RMB 5 million (US$796,330). Before, there were three different tiers of small-scale VAT taxpayers.

The tax cuts are part of an ongoing effort to optimize the VAT system and reduce companies’ tax burdens. At the annual Two Sessions meetings in March, Premier Li Keqiang stated that the government aims to further streamline the VAT system by reducing the number of VAT brackets from three to two.

China’s updated VAT rates:

By Alexander Chipman Koty, China Briefing

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, accounting, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

Apr 25, 2018